Trusted by millions of users in Nigeria

A customer base of over 5 million is a testament to the growing adoption of FairMoney's fintech solutions among Nigerians.

Products that meet all your life goals

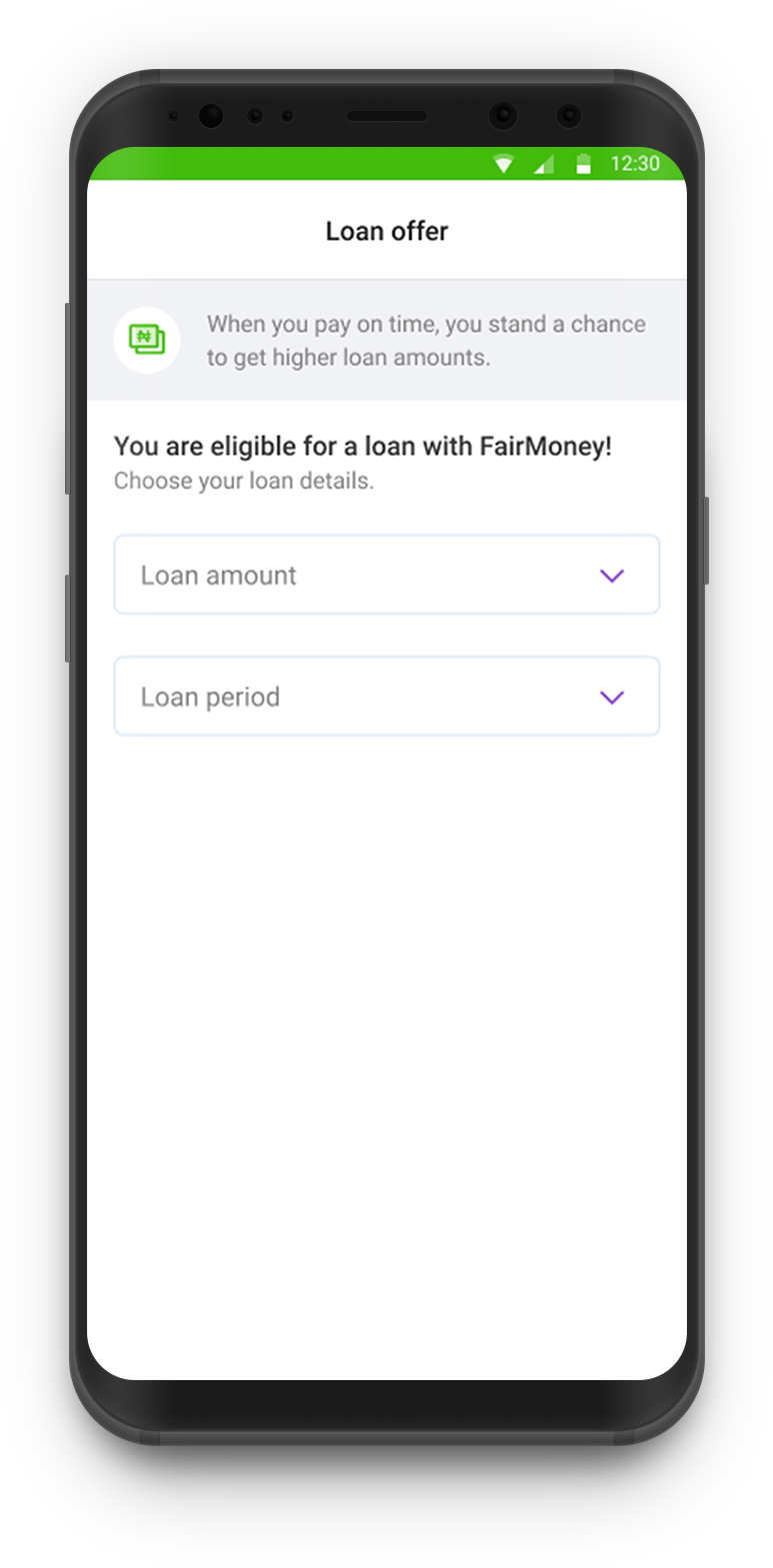

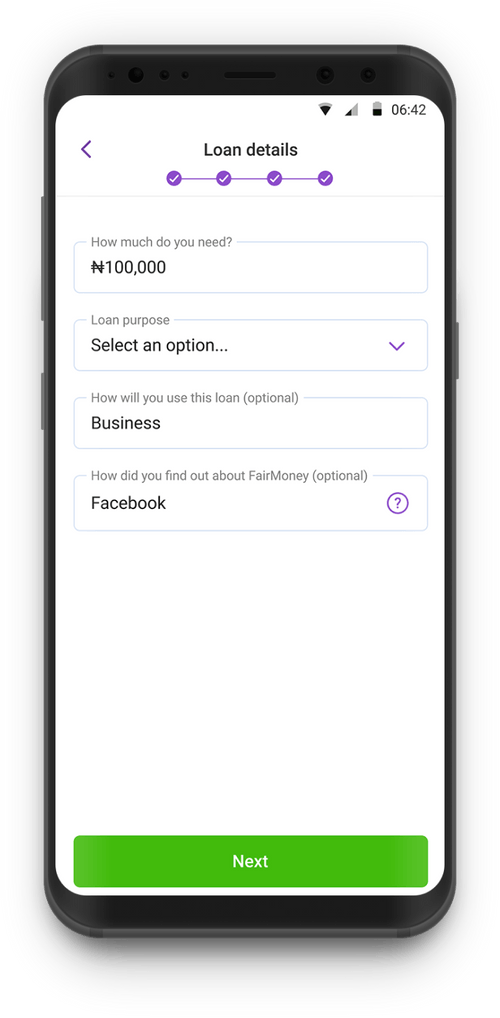

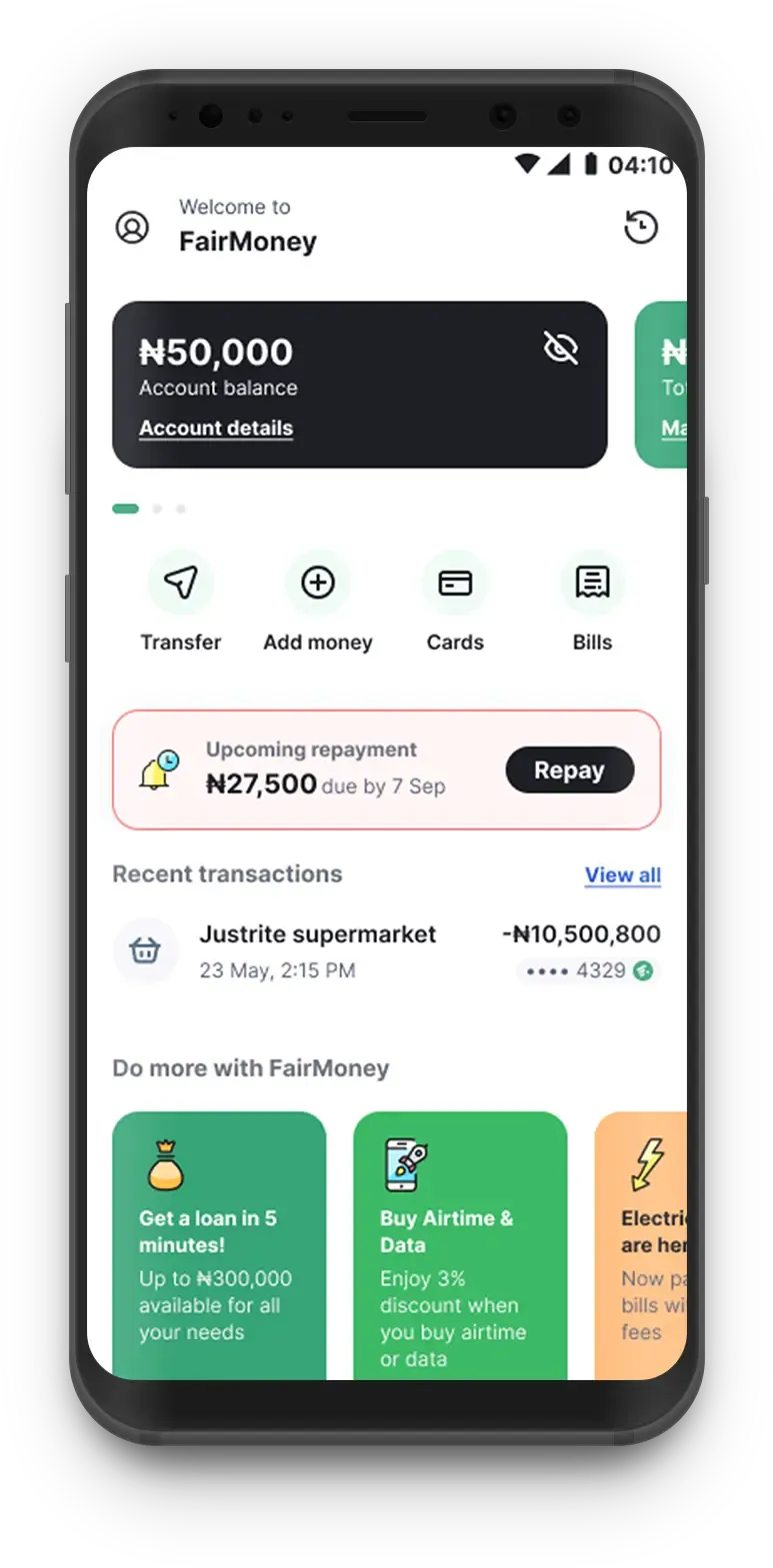

Personal Loans

You can now access quick loans of up to ₦3,000,000 in 5 mins, no collaterals & easy repayment terms!

Learn More

Business Loans

Take your business to the next level with up to ₦5,000,000 FairMoney SME loans.

Learn More

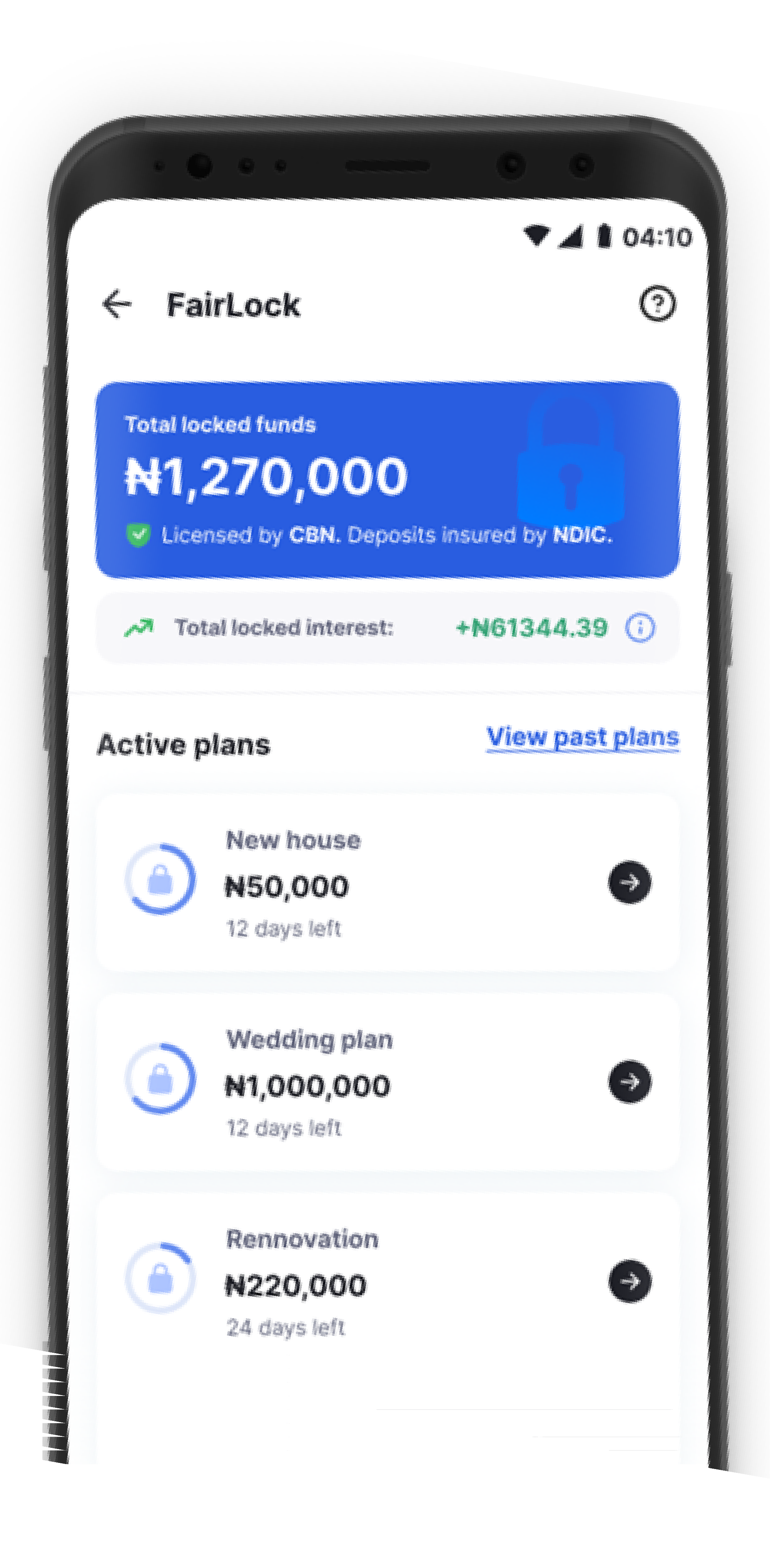

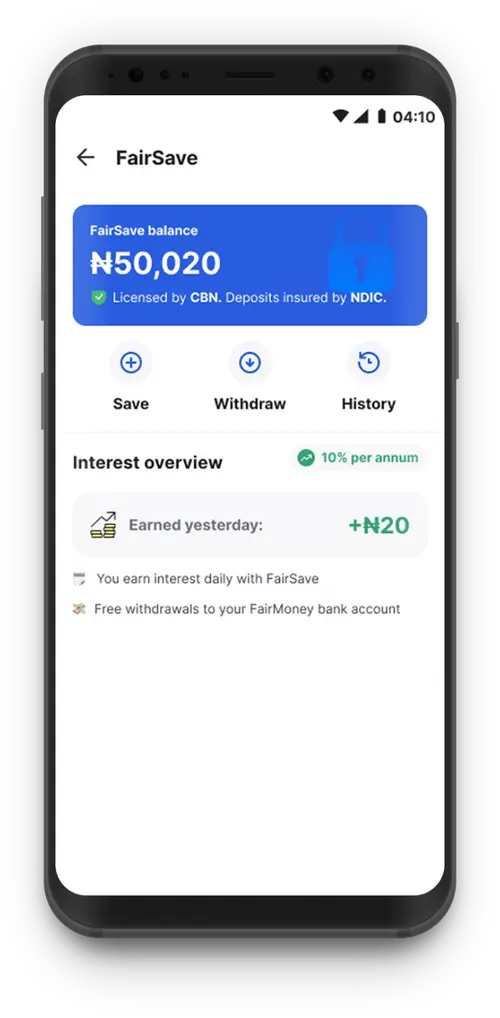

FairLock

Achieve your goals faster with FairLock (Fixed term deposits) & earn up to 24% interest P.A.

Learn More

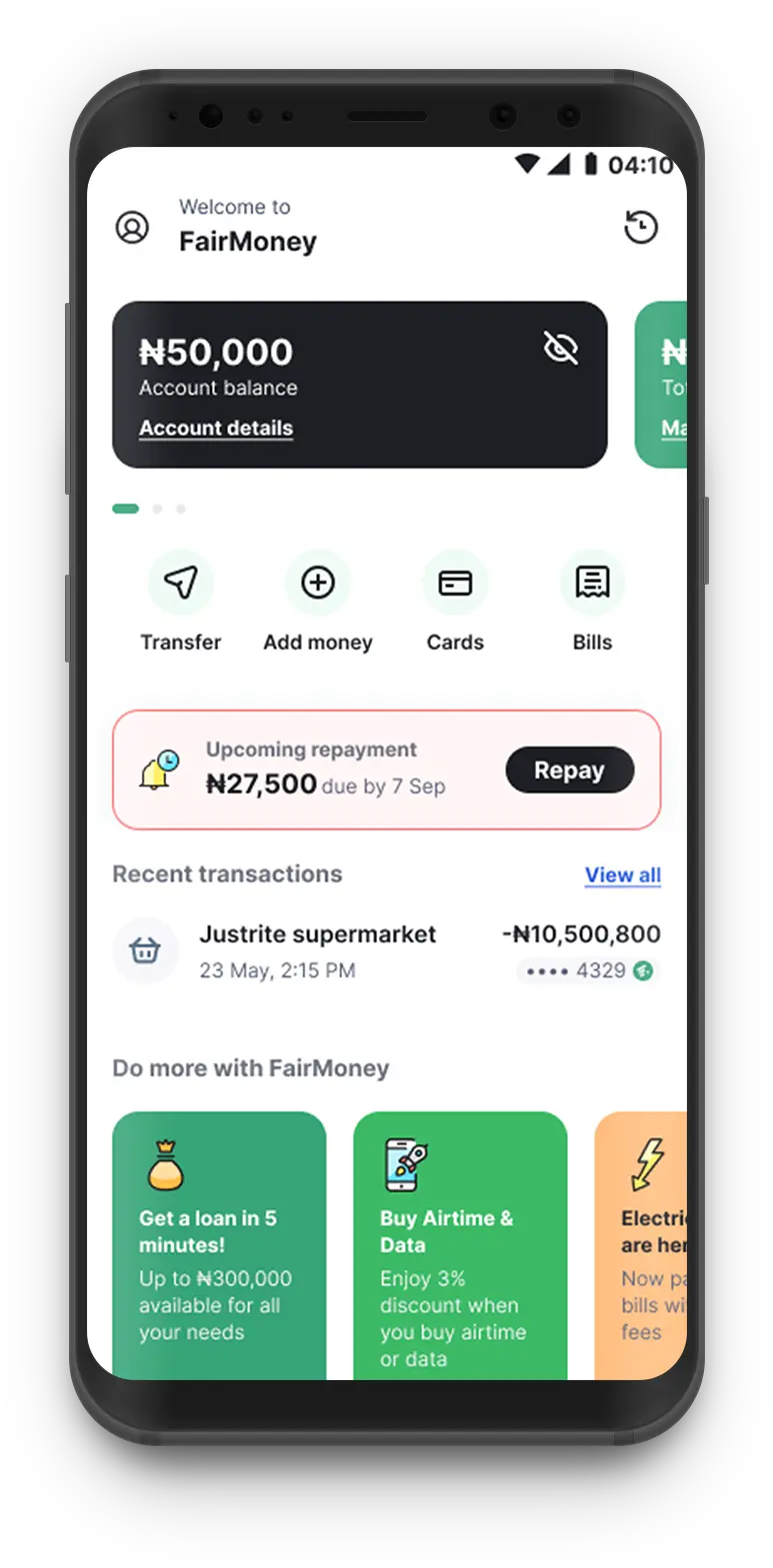

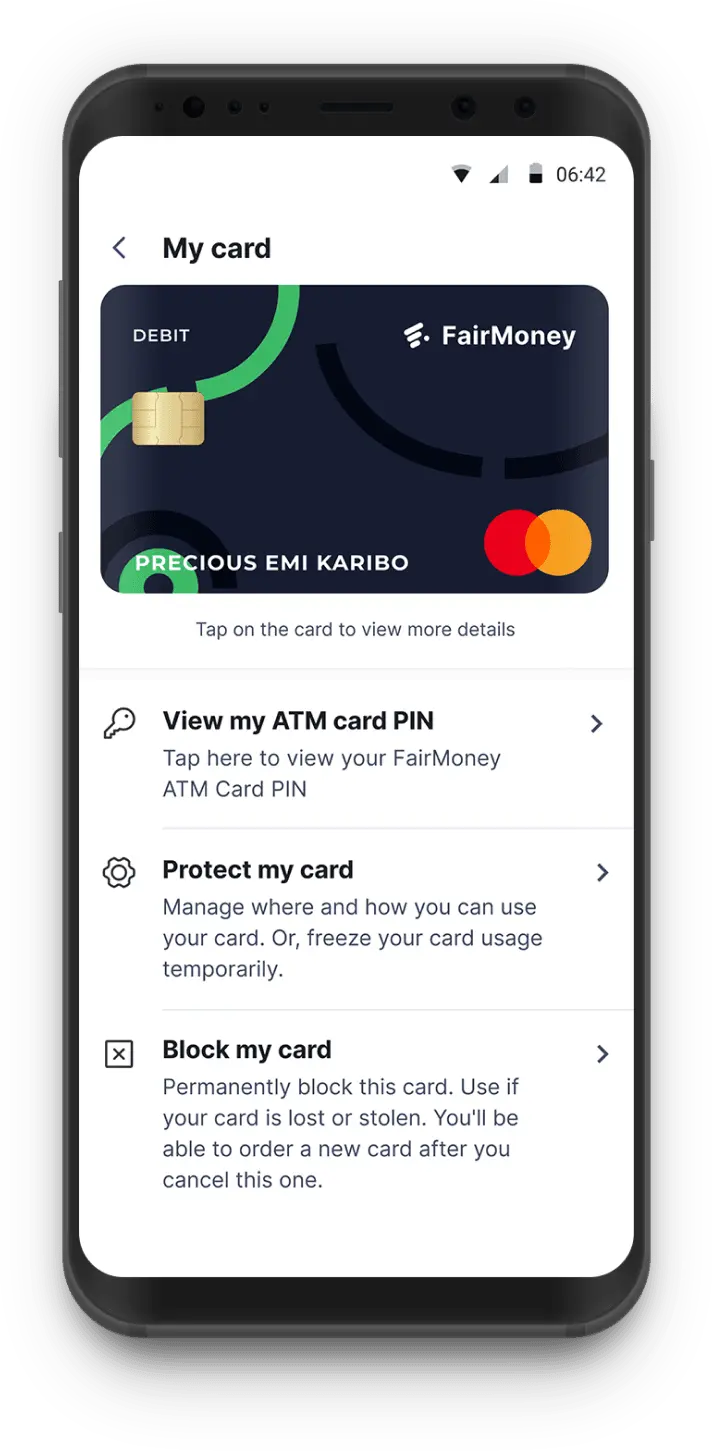

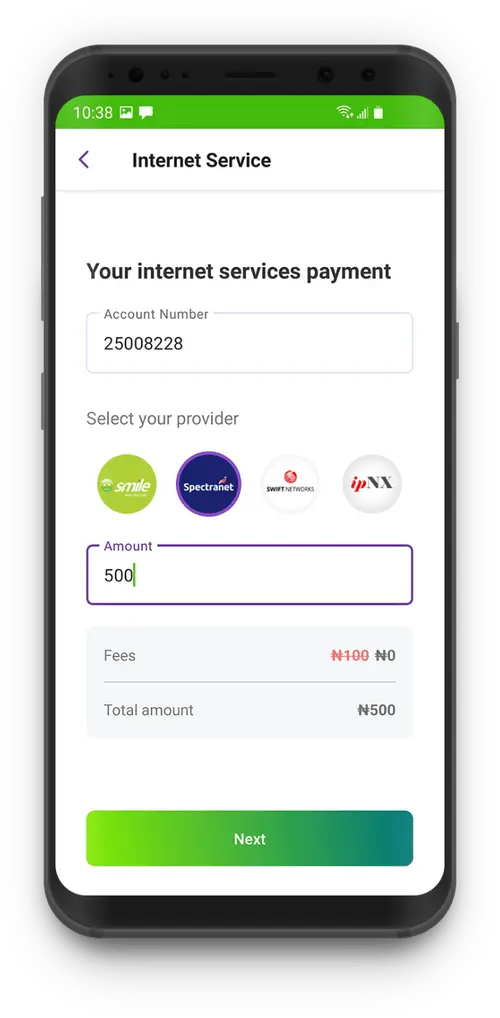

Bank Account

FairMoney offers you 30 free transfers monthly, discounts on airtime/data, no charges on bills, and much more!

Learn More

POS Service

Launch your business on the Payforce network, start earning extra income and accepting payments from anywhere.

Learn More

Testimonials

Latest Blogs

Differences between a current account & savings account?

Do you know the difference between a savings account and a current account? I (It’s Efe here 👋) ...

How to get a small business loan in Nigeria

Have you noticed that everyone has a small or micro business now? From the Iya Bobo that sells dr...

Top 5 savings apps in Nigeria with high interest rates – 2023

Saving money is an essential part of personal finance and can be the key to achieving financial s...

Is it safe to take loans from loan apps in Nigeria?

Last week, my friends and I were having a chat at one of our hang-out spots. My friend on the rig...

Become smart with FairLock

When I was in school, I had this friend who’s Father used to give her the school fees (or at leas...

Emergency Fund. Nice to have or must have?

My people, I’m here again with a topic that is close to my heart. You see, my first job was an in...

Interest rates of online loan apps in Nigeria – 2023

Last night, while chilling at home, an amazing business idea came to me. Next thing I did was to ...

Can you get loans in Nigeria without a salary account?

Loans, loans, loans. We have all heard about them or even taken one at one point or the other. Th...

LESS IS MORE

Hey guys, what’s good? Have you noticed that everytime you jump on social media, you see a post, ...

Top 8 lending apps in Nigeria.

It’s the Ember months! While this signifies the ending part of the year it is also the start of a...